Bond funds have been popular for a long while but warning signs exist that suggest the fervour might be turning to froth and investors will need to look harder for yield.

Globally, government bond real yields are low, central bank manipulation has meant indiscriminate, price-insensitive bulk buying, spreads are tightening and the past decade’s hunt for income has seen so many people allocate to fixed income that liquidity is now a problem.

And yet, despite these signs, people like fixed income.

According to data from the Investment Association (IA), fixed income funds saw a surge of popularity in March 2017.

The data shows fixed income was the third best-selling asset class, with net retail sales of £720m. Overall, fixed income funds were the second-best sellers of the first quarter of the year.

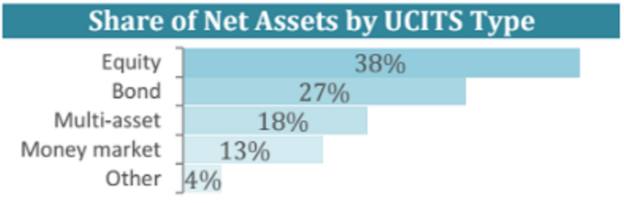

This isn’t just a trend local to the UK. Across Europe, bond funds have been popular with investors; the below graphic from European Fund and Asset Management Association (EFAMA) shows how strong the appeal

In March alone, according to data from the EFAMA, bond funds saw inflows of Euro 32bn, up from Euro 22bn in March. In terms of share of net assets, bond funds were at 27 per cent, compared with 38 per cent for equities.

So what is driving the popularity of the asset class?

Bernard Delbecque, senior director for economics and research at EFAMA, comments: “The upward trend in net sales of Ucits continued in March, thanks to bond funds, which enjoyed their highest monthly net sales ever at a time when investors are looking for return without increasing their exposure to equity markets too much.”

The answer: perceived safety compared with equities, and the lure of a ‘fixed’, quantifiable, regular income in the form of a coupon. People like the idea of a reliable yield without the higher volatility of investing in equities.

However, more recently, the 146-strong IA Global Bond sector has seen average fund performance start to stall after an exceptionally strong run.

Yet over one year, the average global bond fund has returned 8.1 per cent (bid-to-bid, net income reinvested, according to FE Analytics). This compares with the average IA Global Equity Income fund has returned 28.1 (again, net income has been reinvested). All data is at 26 May 2017.

Global bond fund performance seems to have stalled as inflation rises, a tightening US monetary policy cycle starts to impact on US growth, politics and a general global slowdown have come to the fore.

Higher popularity; higher price

So despite the popularity, we are in a tougher environment for bonds, with too many investors chasing too little yield, paying too much for their fixed income exposure, suffering from compressed yields in developed market bonds and experiencing a poor outlook for inflation.

Says Patrick Connolly, head of communications for Chase de Vere: “Many fixed interest assets are expensive, and so yields are correspondingly low.

“This creates a real challenge to advisers, who are looking to construct and manage client portfolios.