Global equities were a volatile place in 2018 and produced little in the way of returns over the past 12 months.

The MSCI All Companies World index – which measures the performance of more than 2,700 companies in 23 developed markets and 24 emerging markets – was down 0.46 per cent in the year to the end of November, on a gross, total return basis.

“After a bearish end to 2018, financial market participants are preoccupied with the question of whether a global downturn is imminent,” says Neil Robson, head of global equities at Columbia Threadneedle.

Question marks relating to a possible downturn in 2019 are justified, given the performance of equities over the past decade. However, the 2018 story has been a complicated one, and the performance of stocks in some geographies had vastly opposing fortunes to others.

This trend of differing fortunes, based on location is one widely predicted to continue throughout 2019.

“In the year ahead, we expect the growth rate of different regions and countries to vary meaningfully,” explains Kate Moore, chief equity strategist for BlackRock. “This will lead to investment opportunities and significant implications for risk assets across all different regions.”

Shifting dynamics

In 2018, it was the US that had the upper hand. North American equities made gross returns of more than 4.1 per cent in the year to the end of November, according to the MSCI North America index, compared to the MSCI Emerging Markets index, which showed a loss of 11.96 per cent.

Gains in North American stocks were predominantly driven by strong GDP growth in the second and third quarters of 2018 (4.2 per cent for the second quarter, 3.5 per cent for the third quarter) and sustained earnings growth in the S&P 500.

Emerging market stocks, by comparison, had a torrid year as a result of tightening US monetary policy and the continued looming threat of a global trade war.

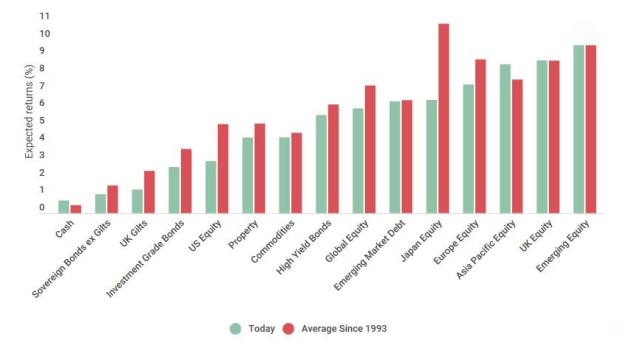

Expected returns across asset classes in 2019

Source: Tilney and MSCI

Investor predictions for 2019 indicate a partial reversal of fortunes, however, with slowing growth in the US. Emerging markets, meanwhile, should see a return to convincing growth, according to fund analysts and portfolio managers.

“As the benefits of substantial fiscal stimulus from US tax cuts and greater public spending wane, US earnings and the broader global economy may have a hard time keeping pace with 2018 levels,” explains Franklin Templeton’s head of equities, Stephen Dover.

Mr Dover is far more bullish when it comes to the outlook for emerging markets and China, in particular, which he predicts will benefit from being more closely driven by its domestic rates of consumption.

He also believes Latin America “offers new promise”.

“The election of Jair Bolsonaro as Brazil’s new president suggests to us a return to more orthodox economic policies, despite some of his more extreme political rhetoric,” he says.