With-profits policies can be traced back to the origins of the UK’s life insurance industry in the late 18th and early 19th centuries.

They began as a way to distribute the excess profits made by life insurance companies to policyholders and developed, over time, to become sophisticated vehicles for long-term investment.

With-profits funds today form the underlying asset for many types of single and regular premium product including Isas, investment bonds, pensions and savings plans.

They reached the zenith of their popularity towards the end of the 20th century, accounting for 42 per cent of new UK life insurance business in 1985, according to the Institute and Faculty of Actuaries.

Key Points

- With-profits funds have been around since the late 18th century

- They are now subject to more stringent regulation

- They may offer opportunities to investors during difficult times

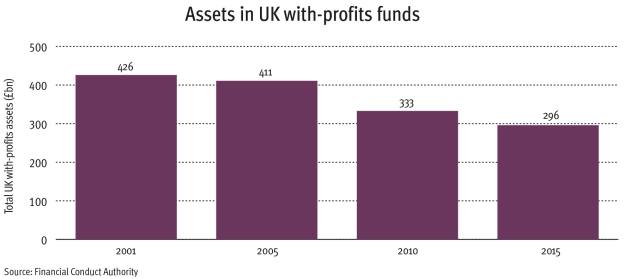

A number of factors around the turn of the millennium, including the well-publicised woes of Equitable Life and the mass demutualisation of much of the UK life insurance sector, saw a decline in the popularity of these policies.

In light of the current ongoing volatility in global financial markets, however, advisers may wish to take another look at a class of products that, by design, can shield investors from experiencing the immediate highs and lows of market performance.

Characteristics of with-profits

With-profits policies share many of the characteristics of investments, and are backed by them. They do not, however, convey ownership of units in a fund on policyholders but are, in fact, long-term insurance contracts.

Customers pay single or regular premiums and benefits are then paid to them in the form of bonuses added to their policies by the insurance company. These bonuses are dependent on the profits made by the underlying fund.

This enables providers to ‘smooth’ out performance by holding back a proportion of gains made in good years to offset the effect of poorer market performance in other years, meaning customers do not usually experience the same highs and lows as those invested in comparable unit-linked products.

It also, in some cases, allows providers to offer capital guarantees that would not be possible with unit-linked investments.

Guarantees

Some products that invest in with-profits funds offer capital guarantees either on the death of the member, on maturity of the policy, or on particular anniversary dates.

These guarantees are highly valued by many clients and are met by retaining a percentage of investment returns within the fund.

The value of any guarantees must be taken into account by the provider when calculating capital adequacy.

In general capital guarantees tend to apply to products with a fixed term, or to be applied on set anniversary dates (for example, the 10th anniversary of opening a product and subsequent five-year anniversaries), or upon the death of the policyholder.

Smoothing

Performance smoothing is carried out by adding bonuses to members’ funds.

These fall into two main categories: regular ‘reversionary’ bonuses added to members’ pots every year and ‘terminal’ or ‘final’ bonuses added when an investment matures or is cashed in.