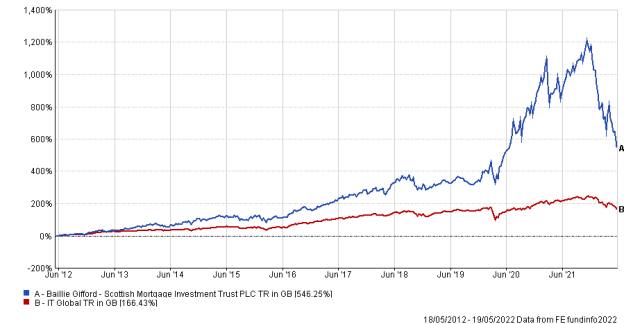

During the decade after the global financial crisis the Scottish Mortgage investment trust dominated the portfolios of many investors.

Its share price total return of more than 700 per cent meant that even after clients stopped adding to their holding, the proportion of their overall portfolio exposed to the trust kept rising.

And with the trust being exposed to technology companies which offered products that were widely adopted during the pandemic, the share price gains seemed less the result of a bubble and more a rational pricing by the market of a changing world.

But this year to date has seen a re-pricing, with the share price falling by around 50 per cent since January 1.

The reasons for this are numerous but includes a general market aversion to tech companies and biotech in a world of higher interest rates. Worries about the attractiveness of investing in Chinese companies amid recent regulatory interventions and the zero-Covid policy pursued by authorities in Beijing have also contributed to the under performance.

Although the trust is associated with large-cap US tech, and continues to have Tesla and Amazon among its top 10 holdings, the fund managers have been increasing exposure to biotech and China in recent years.

Indeed, there are more Chinese large-cap tech stocks – Alibaba, Meituan and Tencent – than US ones in the top 10 holdings.

Scottish Mortgage 10-year performance

The largest investment in the trust is the biotech Moderna, a company which developed a widely used Covid vaccine.

The trust’s managers remained very bullish on China and in 2021 reduced US technology exposure in favour of buying more in China.

The soon-to-retire fund manager James Anderson annoyed a number of the company’s US institutional clients by brushing off concerns about the macro environment in China, saying that (under the presidency of Donald Trump) it was debateable whether the US would still be a democracy in 10 years.

A third factor has been the investment in unquoted companies.

Simon Elliott, head of investment trust research at Winterflood Securities, says: "Investors in Scottish Mortgage investment trust must be forgiven for feeling as if they’re riding a rollercoaster. The trust’s share price is now down more than 40 per cent so far this year and has halved since its peak in November last year.

"This begs the question, should existing investors sell and minimise the risk of a further decline? Conversely, is the current share price an interesting entry point? The answer to both these questions basically depends on investors’ timescale.

"In our opinion, the trust suits long-term investors who can withstand significant drawdowns as have been seen in the past – most notably in 2008 at the time of the global financial crisis."

Elliott adds: "The Baillie Gifford investment team has made it clear that their investment philosophy and approach has not changed, with a focus on identifying exceptional growth prospects, with the potential to generate significant returns. Their track record is impressive in this regard and we rate the long-term global growth team led by Tom Slater highly."